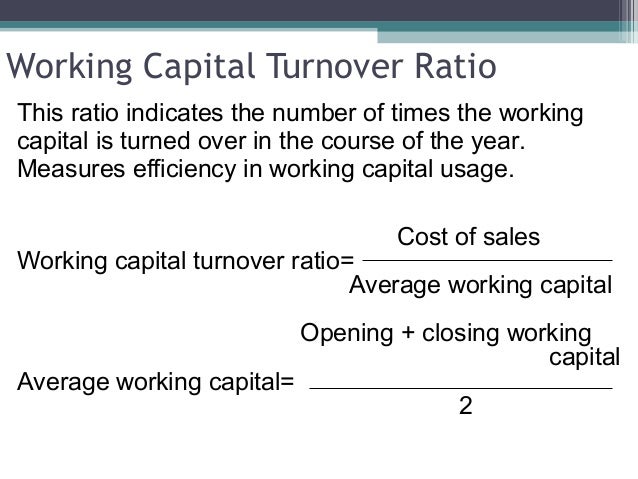

Equity is the difference between assets and liabilities, and you can think of it as the true value of your business.Liabilities include accounts payable and long-term debt. Liabilities are what your business owes to other parties.If you’re a plumber, your truck and the equipment you use are defined as assets. Assets are resources used to produce revenue. Here are the components that make up a balance sheet: A balance sheet is a financial statement that reports assets, liabilities, and equity balances as of a specific date. Working capital = current assets – current liabilitiesĪssets and liabilities are included in a balance sheet, and you’ll use the components of the balance sheet to calculate working capital. A ratio higher than one means that current assets exceed liabilities, resulting in a better score: The working capital formula is calculated by using the current ratio. Obligation funding: Sometimes your business will need working capital to help fund obligations to employees, suppliers, and the government while waiting for customer payments.Covering expenses: Additional working capital may be needed to pay temporary employees or to cover miscellaneous project-related expenses.Supplier discounts: If you need to boost your capital, purchasing in bulk can allow you to take discounts that many suppliers offer.Seasonal differences: Cash flow changes happen seasonally for many businesses, so additional capital may be required to help prep for a busy season or keep things operating when there’s less cash available.Here are some reasons why that may be the case: On top of the many reasons why working capital is important, there are times when your business may need additional capital to stay adaptable with the industry and other business needs.

Reasons your business may require additional working capital Good working capital management will keep your business operational and can help you avoid cash flow problems. If your company’s current assets don’t exceed its short-term liabilities, it won’t survive for long. If you can’t generate enough current assets, you may need to borrow money to fund your business operations. “Financial ratios give you that.Working capital is important because it measures how efficiently a company operates, its financial health, and its liquidity-the ability to generate sufficient current assets to pay current liabilities. “You need objective ways to measure the performance of your business,” says BDC’s Stéphanie Bourret, Regional Manager, Technology Industry Group. Ratios are included in financial dashboards and management reports they’re used by bankers or investors when making lending or investment decisions about your business but, most importantly, they help you understand the health and performance of your company. But checking your ratios should be part of an ongoing assessment of your financials so that you can continuously make informed decisions. Sure, there are the crunch times when you feel you really need them, like an expansion project on the horizon or a customer with a large order asking for longer-than-normal credit terms and you’re not quite sure if you can extend yourself. Ratios reveal basic information about your company, such as whether you have accumulated too much debt, stockpiled too much inventory or are not collecting receivables quickly enough. Keeping track of financial ratios is an essential way for you to examine your company’s financial health. Growth & Transition Capital financing solutions Kauffman Fellows Program Partial Scholarship Venture Capital Catalyst Initiative (VCCI) Industrial, Clean and Energy Technology (ICE) Venture Fund

0 kommentar(er)

0 kommentar(er)